Treasury Yields: Don't Believe the Hype

Okay, so Treasury yields are doing... something. Honestly, trying to make sense of the bond market these days feels like trying to understand what my cat's dreaming about. It's probably weird, and definitely not logical.

The "Debasement Trade": Fear is the Driver

The so-called "debasement trade" is apparently still a thing. The idea, as I understand it, is that governments are going to try to inflate away their massive debts, which will send everyone scrambling for assets that can't be debased – gold, crypto, canned beans, whatever.

But here's where it gets murky. Some "experts" are saying the debasement trade can't be real because inflation break-evens haven't risen. Others point to the fact that longer-term Treasury yields have actually fallen this year as proof that the whole thing is bogus.

Give me a break.

As one source put it, "there doesn’t have to be a rise in inflation break-evens for the debasement trade to drive precious metals prices sharply higher." Why? Because this isn't about spreadsheets and economic models. It's about fear. Fear of losing your retirement, fear of the system collapsing, fear of... well, you name it. And fear, last I checked, isn't exactly known for its rational decision-making.

Markets ain't exactly known for being consistent, are they? We're supposed to believe that everything lines up perfectly, that every market signal confirms every other market signal.

The Yield Curve: Still Inverted, Still Spooky

Then there's the yield curve. You know, that thing that's supposed to predict recessions? The 10-2 spread was negative for ages, then briefly popped back into positive territory, and now it's doing the hokey-pokey.

According to the data, an inverted yield curve is "widely considered a reliable leading indicator for recessions." Except when it isn't. There was that false positive in 1998, and the 2009 recession saw the spread go negative multiple times before finally giving way.

So, what's it telling us now? Honestly, who the hell knows? It's like reading tea leaves, except the tea leaves are covered in jargon and manipulated by central bankers.

And speaking of central bankers... The Fed's been cutting rates, supposedly to stimulate the economy. But mortgage rates initially rose even as the Fed was cutting. Makes perfect sense, right? No? Didn't think so.

What Does It All Mean? (Spoiler: I Have No Idea)

Look, I'm not an economist. I'm just a guy with a keyboard and a healthy dose of cynicism. But here's my take: the financial world is a giant casino, and we're all just gambling with our futures. The "experts" pretend they know what's going on, but let's be real, they're just as clueless as the rest of us. Maybe even more so, considering they're paid to have a narrative.

They throw around terms like "risk premia" and "quantitative easing" like they actually mean something. They build elaborate models based on assumptions that are probably wrong. And then they act surprised when the whole thing blows up in their faces.

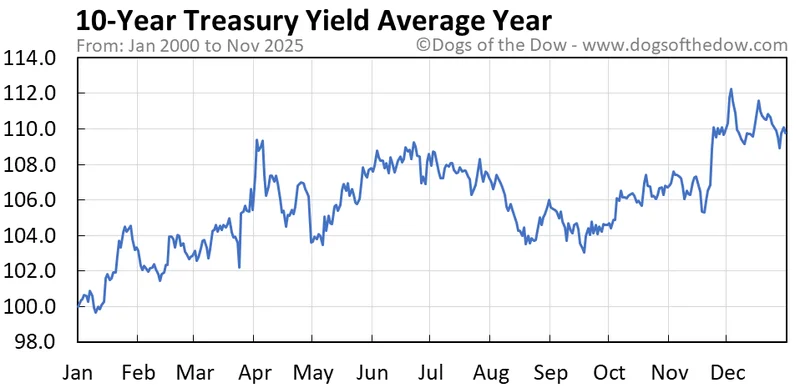

Offcourse, I could be wrong. Maybe there's some grand, unified theory of everything that explains why Treasury yields are doing what they're doing. Maybe the market is perfectly rational, and all the pieces fit together in some elegant, mathematical way. As of November 21, 2025, here's a Treasury Yields Snapshot.

But I doubt it.