The DeFi Reset: Are Smart Investors Seeing a 2026 Boom?

Initial Reactions to the DeFi Crash

Okay, friends, let's talk DeFi. It's been a wild ride, hasn't it? We saw the October 10th crash send ripples (or should I say, tsunamis?) through the crypto markets, and decentralized finance took a serious hit. I saw a headline the other day that just screamed, "DeFi is Dead!" But hold on a minute. Are we really ready to write off the tech that promises to revolutionize finance as we know it? I don’t think so.

Strategic Repositioning by Informed Investors

The data is showing a really fascinating story, and that is that the smart money isn't running for the hills. Instead, it's carefully, strategically, repositioning itself. It’s like watching a chess grandmaster analyze the board after a major piece is taken – the game isn't over; it's just entered a new, more complex phase.

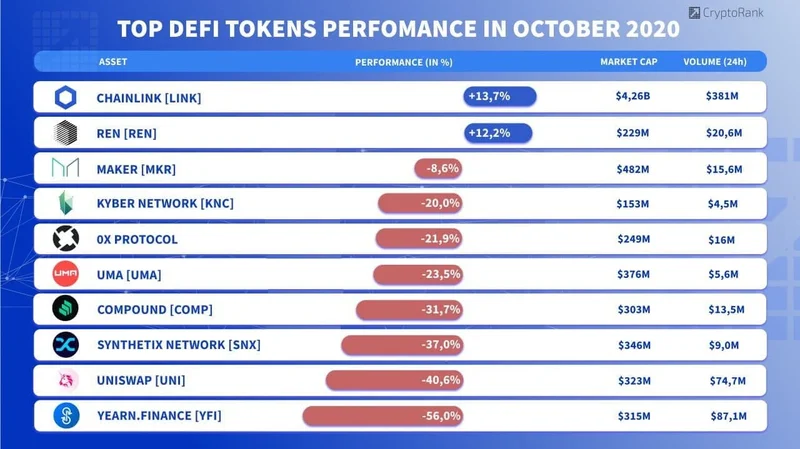

FalconX Report Highlights Shift to Safer DeFi Assets

FalconX’s report is really insightful here. They looked at a basket of leading DeFi tokens and, yeah, the overall picture isn’t pretty. But, here's the thing that caught my eye: investors are gravitating towards safer bets, the ones with buybacks or clear fundamental catalysts. It makes perfect sense, right? In times of uncertainty, you go back to the core principles, the projects with solid foundations and real-world utility. Think of it like this: when a storm hits, you want to be in a well-built house, not a flimsy shack.

The Smart Money's Next Move

And what are these "well-built houses" in the DeFi world? Well, tokens like HYPE and CAKE, which have active buyback programs, have shown relative strength. Then you have MORPHO and SYRUP, which have unique catalysts driving their growth. This isn't just blind faith; it's a calculated assessment of value. It's like investors are saying, "Okay, the market's down, but these projects are actually doing something, actually generating value."

Shifting Valuations in DeFi Subsectors

What’s really fascinating, and what I think a lot of people are missing, is the shifting valuation landscape. Some DeFi subsectors have become cheaper, while others have become more expensive. Spot and perpetual decentralized exchanges (DEXes) are seeing their price-to-sales multiples compress, meaning their prices have fallen faster than their activity. But some DEXes, like CRV, RUNE, and CAKE, are actually increasing their fees. This is where it gets really interesting! It's like the market is saying, "Okay, trading activity might be down overall, but these DEXes are proving their resilience, their ability to generate revenue even in a downturn."

Lending Sector's Increased Stability

On the lending side, things are a bit different. Lending and yield names have generally become more expensive on a multiples basis. Why? Well, investors might be crowding into these names, seeing lending as a more stable, "stickier" activity than trading. It’s like the difference between renting out a house (lending) and flipping it (trading) – one provides a steady income stream, while the other is more speculative. Lending activity might even increase as people move into stablecoins and seek yield opportunities. This is the kind of insight that reminds me why I got into this field in the first place.

Predictions for 2026 and Fintech Integrations

So, what does this all mean for 2026? Well, if FalconX is right, investors are betting that perpetuals will continue to lead the DEX space and that fintech integrations will drive growth in lending. AAVE's upcoming high-yield savings account and MORPHO's expansion of its Coinbase integration are prime examples of this trend. DeFi Token Performance & Investor Trends Post-October Crash

Ethical Considerations for DeFi's Future

But, as with any emerging technology, there are ethical considerations we need to keep in mind. As DeFi becomes more integrated into our financial lives, we need to ensure that it's accessible to everyone, not just the privileged few. We need to build systems that are fair, transparent, and secure, systems that empower individuals rather than exploit them. Because what good is a revolution if it only benefits a small elite?

DeFi's Potential to Democratize Finance

This reminds me of the early days of the internet. People were saying it was a fad, a toy for nerds. But look at us now! The internet has transformed every aspect of our lives, from how we communicate to how we do business. I think DeFi has the same potential. It has the potential to democratize finance, to create a more inclusive and equitable financial system.

Challenges and the Path Forward

But here’s the thing: it’s not going to be easy. There will be setbacks, there will be challenges, there will be moments when we want to give up. But we can't. We have to keep pushing forward, keep innovating, keep building. Because the future of finance depends on it.

DeFi's Evolution, Not Demise

I saw an insightful comment on Reddit the other day that really resonated with me. Someone said, "DeFi isn't dead, it's just evolving." And I think that's exactly right. It's going through a period of growing pains, a period of consolidation, a period of reevaluation. But it's not going away. It's here to stay, and it's going to change the world. The speed of this is just staggering—it means the gap between today and tomorrow is closing faster than we can even comprehend.

DeFi Isn't Dead, It's Leveling Up

So, what does this all mean? It means that the DeFi revolution is still very much alive and kicking. Smart investors are seeing the potential for a 2026 boom, and they're positioning themselves accordingly. This isn't just about making money; it's about building a better future. It's about creating a financial system that's more fair, more transparent, and more accessible to everyone. And that's a future I'm excited to be a part of.